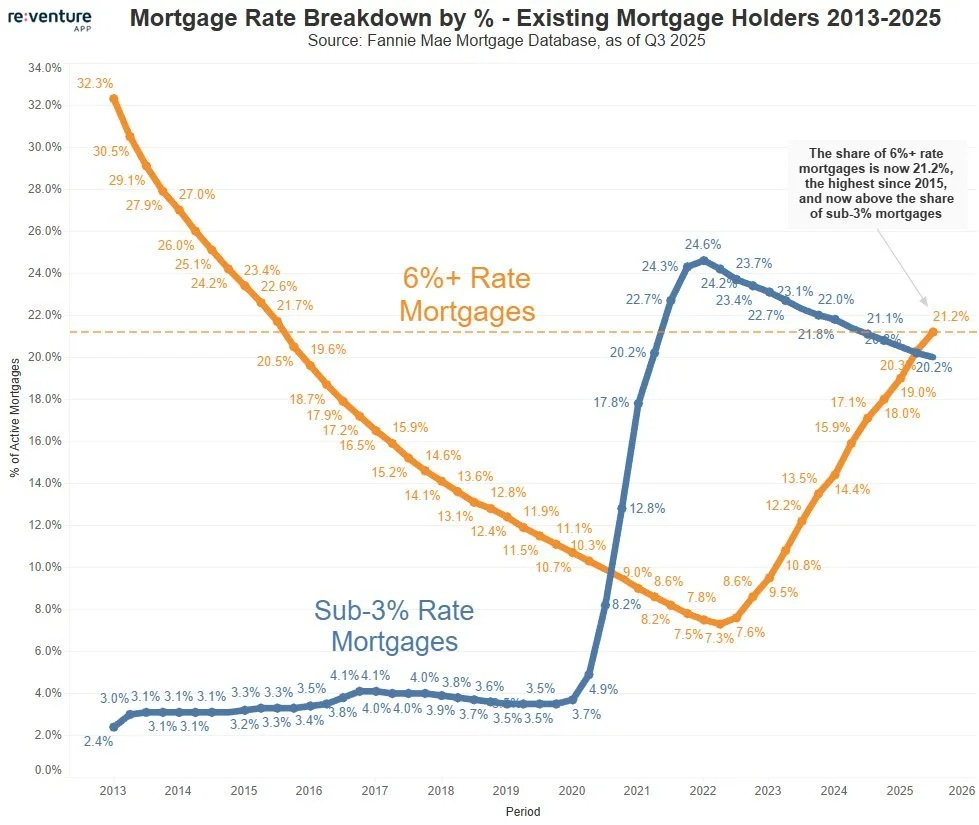

Many homeowners got super-low mortgage rates (under 3%) during the pandemic. That made them hesitant to sell and buy a new home, because new mortgages are around 6-7%, much higher! This "lock-in effect" kept a lot of homes off the market, leading to low inventory and high prices.But things are changing:

More people are now getting mortgages at higher rates (over 6%), so that lock-in is slowly fading.

There are more homes for sale now, inventory rose a lot in 2025 (up 16-18% in many reports), and it's continuing into 2026. We're seeing levels closer to normal pre-pandemic times in some areas.

Buying a home is often more expensive than renting right now. On average, a monthly mortgage payment (with taxes and insurance) is about 38% higher than rent for a similar place. Rents have stayed pretty stable or even softened a bit.

What does this mean?

For buyers: More choices! Homes are sitting on the market longer, and sellers are more willing to negotiate. Prices aren't skyrocketing anymore, in fact, growth slowed way down in 2025 and should stay modest (around 1-2%) in 2026.

For sellers: It's not as crazy-competitive as before. You might need to price realistically and be patient, but steady demand means homes are still selling.

Overall, the market is getting more balanced, not too hot for sellers, not too cold for buyers. If you're thinking of buying or selling, contact one of our team members!